Dalal Street Week Ahead - The AdWiser

Dalal Street Week Ahead

Updated to Financial Year 2025-26 - Quarter 1 - April - Week # 3

Top 10 Market Movers: Q4 Earnings, Inflation Print, ECB Meet, China GDP, Tariff Trends & More

Market Outlook: April Week 3 – Holiday-Shortened, Cautious, and Data-Heavy

Indian equities are set to begin a holiday-shortened week on a cautious note, as investors weigh a subdued start to the Q4 earnings season, escalating US-China trade tensions, and a slate of key macro data releases.

The benchmark indices ended the previous truncated week (April 8–11) on a moderately negative note, marked by volatility. The Nifty 50 declined 76 points to close at 22,829, while the BSE Sensex dropped 207 points to settle at 75,157. Despite the losses, markets recouped nearly 1,100 points from Monday’s lows, supported by a recovery in global sentiment.

The week began with a sharp sell-off triggered by the imposition of steep reciprocal tariffs by the U.S. across major trading partners. However, relief came mid-week after President Donald Trump announced a 90-day pause on tariffs for all countries except China, allowing markets to claw back losses.

Indian equities are set to begin a holiday-shortened week on a cautious note, as investors weigh a subdued start to the Q4 earnings season, escalating US-China trade tensions, and a slate of key macro data releases.

The benchmark indices ended the previous truncated week (April 8–11) on a moderately negative note, marked by volatility. The Nifty 50 declined 76 points to close at 22,829, while the BSE Sensex dropped 207 points to settle at 75,157. Despite the losses, markets recouped nearly 1,100 points from Monday’s lows, supported by a recovery in global sentiment.

The week began with a sharp sell-off triggered by the imposition of steep reciprocal tariffs by the U.S. across major trading partners. However, relief came mid-week after President Donald Trump announced a 90-day pause on tariffs for all countries except China, allowing markets to claw back losses.

Key Headwinds This Week

TCS Earnings Miss: The IT major’s Q4 results fell short of expectations, with management highlighting the impact of geopolitical uncertainties and trade-related delays in discretionary IT spending.

US-China Trade War: Ongoing tensions between the world’s two largest economies continue to weigh on global growth outlooks, contributing to cautious investor sentiment.

Earnings Season in Focus: More corporate results, including from Infosys, Wipro, HDFC Bank, and ICICI Bank, will shape stock-specific action.

Macro Watchlist: Investors will closely monitor India’s March inflation print, China’s Q1 GDP, and the European Central Bank's interest rate decision.

TCS Earnings Miss: The IT major’s Q4 results fell short of expectations, with management highlighting the impact of geopolitical uncertainties and trade-related delays in discretionary IT spending.

US-China Trade War: Ongoing tensions between the world’s two largest economies continue to weigh on global growth outlooks, contributing to cautious investor sentiment.

Earnings Season in Focus: More corporate results, including from Infosys, Wipro, HDFC Bank, and ICICI Bank, will shape stock-specific action.

Macro Watchlist: Investors will closely monitor India’s March inflation print, China’s Q1 GDP, and the European Central Bank's interest rate decision.

Sectoral Trends

Amid the broader weakness, beaten-down sectors such as IT, metals, and capital goods saw a modest relief rally. The Nifty Midcap 100 fell 0.3%, while the Nifty Smallcap 100 edged up 0.13%, signaling mixed undertones in broader markets.

“The upcoming holiday-shortened week will remain sensitive to further developments on the US-China tariff front,” said Hari, Partner at MWISE. “Volatility is expected to persist, influenced by global cues and corporate earnings.”

Amid the broader weakness, beaten-down sectors such as IT, metals, and capital goods saw a modest relief rally. The Nifty Midcap 100 fell 0.3%, while the Nifty Smallcap 100 edged up 0.13%, signaling mixed undertones in broader markets.

“The upcoming holiday-shortened week will remain sensitive to further developments on the US-China tariff front,” said Hari, Partner at MWISE. “Volatility is expected to persist, influenced by global cues and corporate earnings.”

Trading Holidays This Week

April 14 (Sunday) – Dr. Babasaheb Ambedkar Jayanti (weekend)

April 18 (Thursday) – Good Friday (Stock markets closed)

April 14 (Sunday) – Dr. Babasaheb Ambedkar Jayanti (weekend)

April 18 (Thursday) – Good Friday (Stock markets closed)

Here are 10 key factors to watch out for next week:

Corporate Earnings Season Picks Up Pace

The Q4 earnings season will gather momentum as major IT companies like Infosys and Wipro, and banking heavyweights HDFC Bank and ICICI Bank, release their results. HDFC Life Insurance is also scheduled to announce its numbers.

Other notable earnings include HDFC AMC, ICICI Lombard, ICICI Prudential, Tata Elxsi, Mastek, IREDA, Angel One, Waaree Renewable, Indosolar, Mahindra EPC, Network 18, and Yes Bank.

Stock-specific action will likely dominate. Hari notes that markets are entering the earnings season with subdued expectations. “Initial results from TCS reflect the impact of trade tensions and indicate delays in discretionary spending,” he said.

The Q4 earnings season will gather momentum as major IT companies like Infosys and Wipro, and banking heavyweights HDFC Bank and ICICI Bank, release their results. HDFC Life Insurance is also scheduled to announce its numbers.

Other notable earnings include HDFC AMC, ICICI Lombard, ICICI Prudential, Tata Elxsi, Mastek, IREDA, Angel One, Waaree Renewable, Indosolar, Mahindra EPC, Network 18, and Yes Bank.

Stock-specific action will likely dominate. Hari notes that markets are entering the earnings season with subdued expectations. “Initial results from TCS reflect the impact of trade tensions and indicate delays in discretionary spending,” he said.

Tariff Developments and Global Trade Tensions

All eyes will be on the evolving US-China trade war. Although President Trump recently announced a 90-day pause on reciprocal tariffs for all partners except China, tensions remain high.

The U.S. has hiked tariffs on Chinese goods to 145%, excluding critical tech products (a relief for firms like Apple), while China retaliated by raising tariffs on all U.S. goods to 125%.

Hari adds, “The market is watching closely — any escalation could dampen emerging market sentiment, despite a temporary pause for others.”

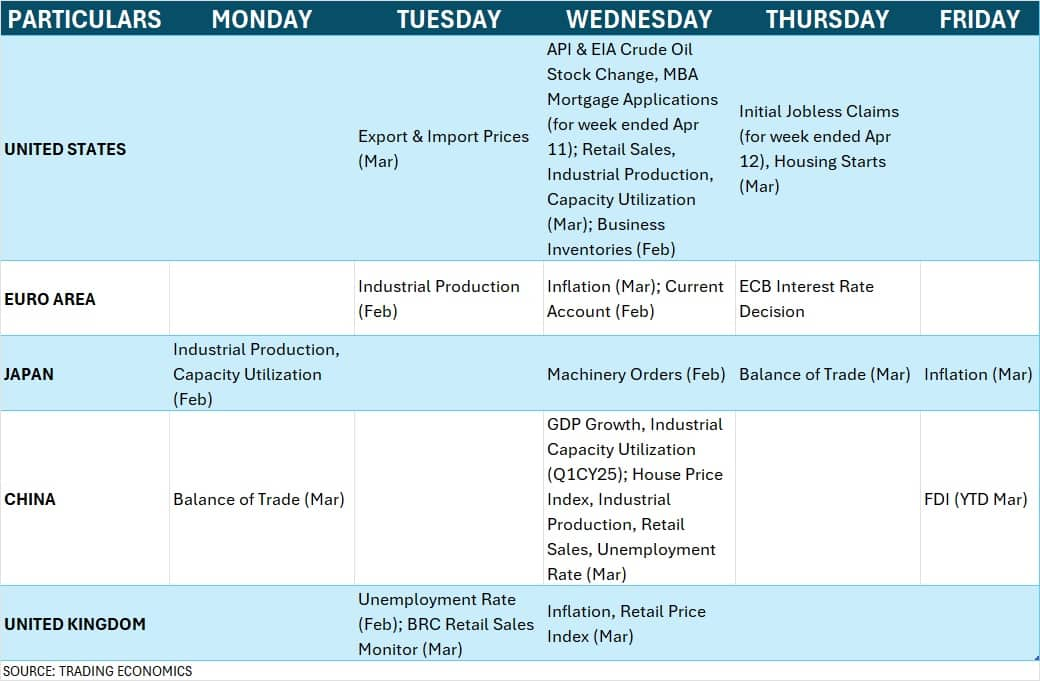

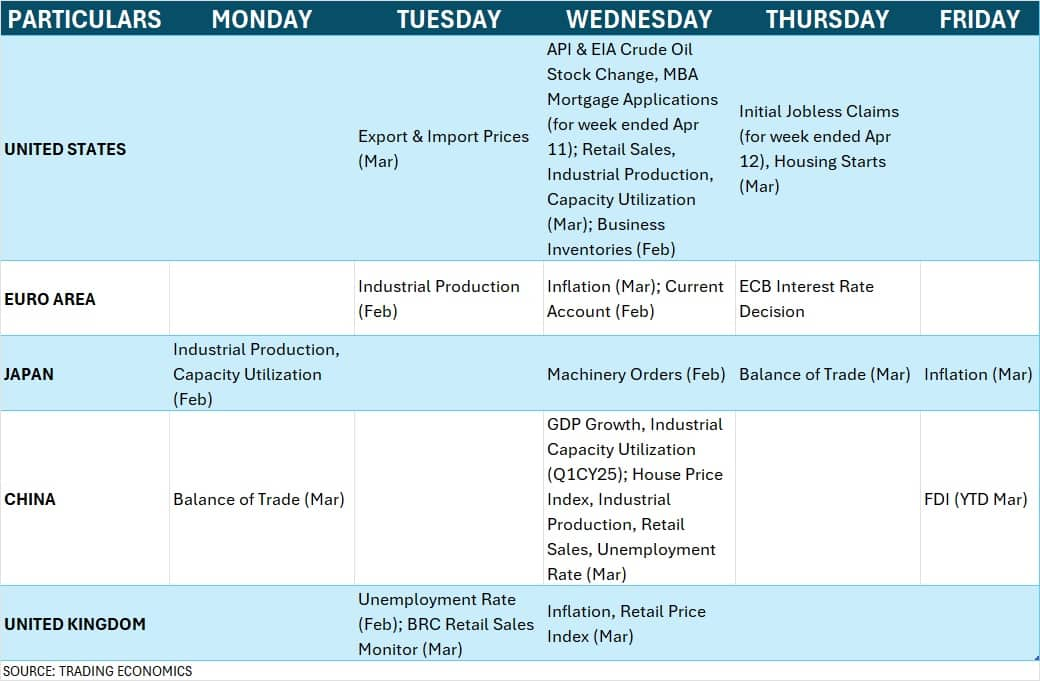

Fed Watch: Jerome Powell Speech

Fed Chair Jerome Powell is scheduled to speak on April 16, a key event for global markets. His earlier comments indicated a wait-and-watch approach amid rising uncertainty from the trade war.

Investors will also monitor:

US weekly jobless claims

Retail sales

Industrial production (March)

These will shape expectations around the rate cut trajectory.

Fed Chair Jerome Powell is scheduled to speak on April 16, a key event for global markets. His earlier comments indicated a wait-and-watch approach amid rising uncertainty from the trade war.

Investors will also monitor:

US weekly jobless claims

Retail sales

Industrial production (March)

These will shape expectations around the rate cut trajectory.

ECB Meet, China GDP & Global Macro Data

On the global front, attention will turn to:

The European Central Bank (ECB) policy meeting, where a 25 bps cut in deposit rate to 2.25% is widely expected.

China’s Q1 GDP, likely to show a slowdown to 5.1% (from 5.4% in Q4 CY24), amid trade headwinds.

Eurozone inflation data for March

These figures will influence risk sentiment in global equities.

On the global front, attention will turn to:

The European Central Bank (ECB) policy meeting, where a 25 bps cut in deposit rate to 2.25% is widely expected.

China’s Q1 GDP, likely to show a slowdown to 5.1% (from 5.4% in Q4 CY24), amid trade headwinds.

Eurozone inflation data for March

These figures will influence risk sentiment in global equities.

India Inflation Data

India's March CPI inflation, due April 15, is expected to remain moderate or decline from 3.61% in February, thanks to softening food prices.

Hari expects this trend to give more leeway to the RBI to maintain its accommodative stance. Other domestic macro data due next week:

Forex reserves (April 11 week) – April 18

Passenger vehicle sales data (March)

India's March CPI inflation, due April 15, is expected to remain moderate or decline from 3.61% in February, thanks to softening food prices.

Hari expects this trend to give more leeway to the RBI to maintain its accommodative stance. Other domestic macro data due next week:

Forex reserves (April 11 week) – April 18

Passenger vehicle sales data (March)

Oil Prices & OPEC+ Outlook

Brent crude prices slipped to a near 4-year low last week due to recession fears and the trade war, before recovering to close 1.25% lower at $64.76/barrel.

Technical signals suggest continued weakness, with crude trading below all key EMAs. The EIA has slashed global oil demand forecast for 2025 by 400,000 barrels/day.

Markets will also watch the OPEC+ meeting on May 5, where supply-side support measures could be announced.

“Short-term outlook remains bearish unless trade tensions ease or China injects stimulus,” said Hari, Partner at MWISE.

Brent crude prices slipped to a near 4-year low last week due to recession fears and the trade war, before recovering to close 1.25% lower at $64.76/barrel.

Technical signals suggest continued weakness, with crude trading below all key EMAs. The EIA has slashed global oil demand forecast for 2025 by 400,000 barrels/day.

Markets will also watch the OPEC+ meeting on May 5, where supply-side support measures could be announced.

“Short-term outlook remains bearish unless trade tensions ease or China injects stimulus,” said Hari, Partner at MWISE.

FII Flows: Selling Pressure Persists

FIIs have been persistent net sellers this month, offloading ₹34,641.79 crore in the cash segment, primarily due to tariff-related concerns. Meanwhile, DIIs have absorbed some pressure, with net buying of ₹27,588.18 crore.

Technical View: Nifty in Consolidation Mode

Nifty 50 ended the week defending its 100-week EMA, forming a long bullish candle. However, the formation of lower highs and lows, and trading below the 20/50-week EMAs suggest short-term weakness.

Resistance levels: 22,900 (immediate), 23,000–23,050

Support levels: 22,700 > 22,550 > 22,250

Momentum indicators suggest lack of clear directional bias, implying possible consolidation.

Nifty 50 ended the week defending its 100-week EMA, forming a long bullish candle. However, the formation of lower highs and lows, and trading below the 20/50-week EMAs suggest short-term weakness.

Resistance levels: 22,900 (immediate), 23,000–23,050

Support levels: 22,700 > 22,550 > 22,250

Momentum indicators suggest lack of clear directional bias, implying possible consolidation.

F&O Cues: Resistance at 23,000; Support at 22,500

In the derivatives market:

Maximum Call OI: 23,500, followed by 23,000

Maximum Put OI: 22,500, followed by 22,800

India VIX stayed elevated, closing above 20 at 20.11, reflecting caution. A drop in VIX could support bullish sentiment.

In the derivatives market:

Maximum Call OI: 23,500, followed by 23,000

Maximum Put OI: 22,500, followed by 22,800

India VIX stayed elevated, closing above 20 at 20.11, reflecting caution. A drop in VIX could support bullish sentiment.

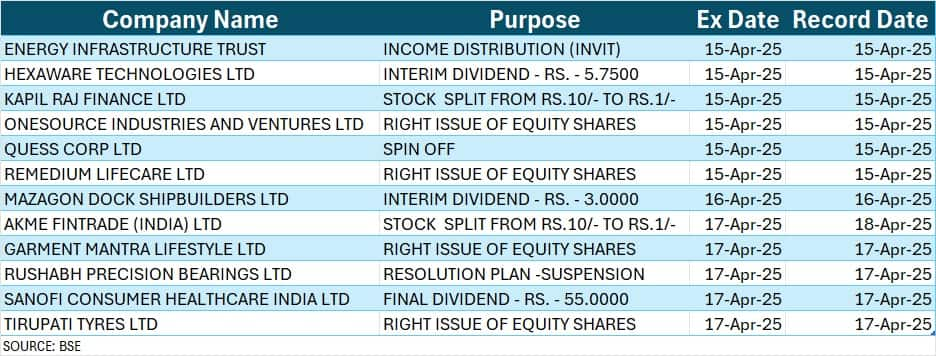

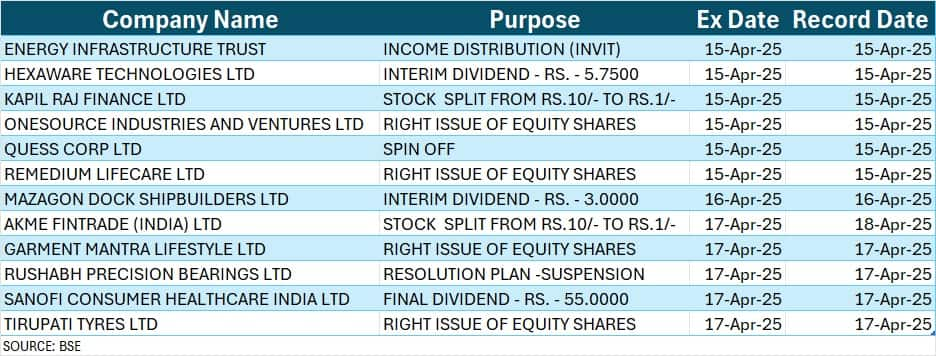

Corporate Action Tracker

Here are key corporate actions taking place next week:

I recently came across The AdWiser's blog and found the post titled "Dalal Street Week Ahead" particularly insightful and timely. The analysis was sharp, data-driven, and incredibly well-articulated — it’s evident that a lot of thought and effort goes into each post. As someone who actively follows market trends, I found the commentary to be both grounded and forward-looking, which is a rare balance to strike.

ReplyDeleteHaving explored all the posts on the blog, I must also highlight how much I appreciated the Geopolitical piece on India & China. It offered a nuanced perspective on a complex issue and managed to tie in broader global themes with local economic implications seamlessly. I’d love to see The AdWiser write more such pieces — especially those that connect geopolitics with market movements. Keep up the great work!

PS: Instead of updating the same blog post every time, kindly consider creating a new post each week — it’ll be easier to track changes and revisit previous insights.

Dear QC,

DeleteThank you for your thoughtful and encouraging comments on The AdWiser blog! It’s immensely rewarding to hear that you found the "Dalal Street Week Ahead" post insightful and timely. Your recognition of the effort and detail that goes into crafting each post is truly heartening. Striking the balance between grounded analysis and forward-looking commentary is something I always strive for, and your feedback reassures me that it resonates with readers like you.

I'm thrilled that the Geopolitical piece on India & China caught your attention. It's a topic close to my heart, and I firmly believe that understanding the interplay between geopolitics and economic trends is crucial for making informed decisions. Your suggestion to create more pieces linking geopolitics to market movements is greatly appreciated, and I’ll certainly keep it in mind for future posts.

Regarding your PS — that's an excellent recommendation! Creating separate posts each week for updates not only helps track changes better but also ensures the accessibility of insights for readers. I’ll consider incorporating this approach going forward.

Thank you once again for your kind words and constructive feedback, QC. Your engagement inspires me to continue refining and expanding the content I create. Keep reading, and I hope to hear more of your thoughts in the future!

Warm regards,

The AdWiser